In most countries of the world all mineral resources belong to the government. This includes all valuable rocks, minerals, oil or gas found on or within the Earth. In the United States ownership of mineral resources was originally granted to the individuals or organizations that owned the surface.

In most countries of the world all mineral resources belong to the government. This includes all valuable rocks, minerals, oil or gas found on or within the Earth. In the United States ownership of mineral resources was originally granted to the individuals or organizations that owned the surface.

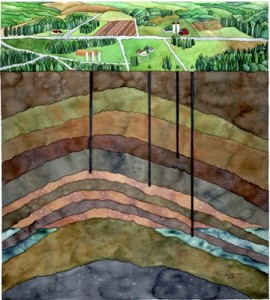

These property owners had both “surface rights” and “mineral rights”, the complete ownership which is known as a “fee simple estate”. The landowner holds title to the surface of the land, the space above it, and the subsoil below it (all the way down, in a narrowing pie-shaped wedge, to the center of the earth).

He also owns any minerals contained in the land. To him alone belong the rights to explore, dig, drill, produce, and benefit from minerals on his estate. Mineral rights also include the rights to any oil and natural gas that exist beneath a property. The rights to these commodities can be sold or leased to others. In most cases, oil and gas rights are leased.

The owner of a fee simple estate may sell his entire interest (all of his legal rights) in the land, sell only the surface and retain the minerals for himself, or sell only the minerals and keep the surface (in which case he becomes owner of the “fee in surface”).

If he does sever or separate his interests, he creates a surface estate and a mineral estate. These are then considered to be separate estates, legally speaking. They may be sold to separate owners, leased to separate companies or individuals, and divided again and again as they are conveyed (transferred) for various purposes.

Most states have laws that govern the transfer of mineral rights from one owner to another. They also have laws that govern mining and drilling activity. These laws vary from one state to another.

The process of fracking is used to extract oil or natural gas deep below the Earth’s surface in oil and gas development. Blasts of water, chemicals and sands are pumped into the ground and used to fracture shale, which then releases natural gas or oil. Because it takes place thousands of feet below the ground, many believe it poses a threat to the environment.

The process of fracking is used to extract oil or natural gas deep below the Earth’s surface in oil and gas development. Blasts of water, chemicals and sands are pumped into the ground and used to fracture shale, which then releases natural gas or oil. Because it takes place thousands of feet below the ground, many believe it poses a threat to the environment. The predominant source of lease income for mineral owners comes from oil and gas royalties, not bonus payment, so the purpose of the continuous development clause is to incentivize the lessee to continue drilling more wells over time in order to hold all the acreage in the lease, especially after the primary term has expired. The idea behind this clause is that the lessee should have a reasonable time to fully develop the leased premises, after which the lessee should release the portion of the leased premise not necessary for the production of the wells it has drilled.

The predominant source of lease income for mineral owners comes from oil and gas royalties, not bonus payment, so the purpose of the continuous development clause is to incentivize the lessee to continue drilling more wells over time in order to hold all the acreage in the lease, especially after the primary term has expired. The idea behind this clause is that the lessee should have a reasonable time to fully develop the leased premises, after which the lessee should release the portion of the leased premise not necessary for the production of the wells it has drilled. An overriding royalty interest is the right to receive revenue from the production of oil and gas from a well. The overriding royalty is carved out of the lessee’s (operator’s) working interest and entitles its owner to a fraction of production. It is limited in duration to the terms of an existing lease, but is not subject to any of the expenses of development, operation or maintenance.

An overriding royalty interest is the right to receive revenue from the production of oil and gas from a well. The overriding royalty is carved out of the lessee’s (operator’s) working interest and entitles its owner to a fraction of production. It is limited in duration to the terms of an existing lease, but is not subject to any of the expenses of development, operation or maintenance.